两种或两种以上材质(同种或异种),通过加热或加压或两者并用,来达到原子之间的结合而形成连接的工艺过程叫焊接。各种〒焊接方法、焊接材料、焊接工艺以及焊接设备等及其基础理论的总称叫焊接技术。

激光熔覆的应用: 激光熔覆是使用激光作为热源将金属涂层施加到零件表面的工艺。该过程通常用于创建保护涂层以增加功能,以及修复损坏或磨损的表面。激光熔覆可以延长设备和机械的使』用寿命,其中部件...

什么是激光熔覆? 激光熔覆是一种焊接工艺,它使用聚焦的激光束在部件表面产生熔池。金属进料同时注入熔池并完全熔化以形成沉积物。进料通常采用金属粉末的形式,但也可以是金属丝︾。成功的激光熔覆的...

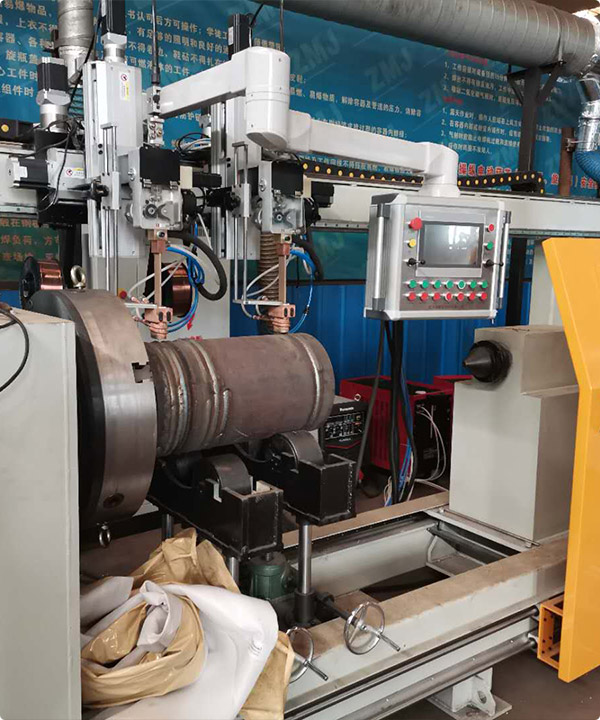

6月22日特邀我厂工程师对自动焊接的操作流程↓进行的规范演示,具体内容包括:自动焊接设备的结构,自动焊接设备的操作要求。自动焊接设备的结构由焊接电源、焊机头、焊件移动或更换装置、辅助装置(送丝装置、焊机...

查看详情+

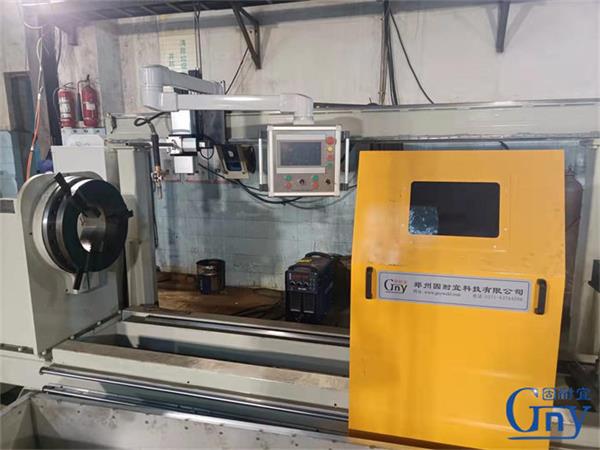

河南机器人作为一家高端堆焊设备生产厂家,我们一直致力于提供...的产品和服务。在行业中,我们拥有着广泛的影响力和良好的声誉。我们始终坚持【用..的技术、..的管理和严格的质量控制来承诺我们的客户,..生产的产品达到..标准和顾客的期望。我们深知,以质量为本是企业持续发展的关键因素。我们的团队由经验丰富的专业人士组成,他们...

查看详情+用主动焊接加工设备注意事项:1、主动焊接加工设备,是一种⌒ 灵活多样的焊接加工方法,支持点焊和拖拉焊。主动焊接设备的一切工艺参数均可由客户自行设定,以习惯各种高难度的焊接操作和微焊接工艺,一切焊接参数均可...

焊接机器人操作是需要技巧的,而且一台焊接机器人设备成本也是比较高的,那么如何正确使用和维护焊接机器人,固耐宜机器人厂家是这样回答的。1.自动焊接机器人操作人员的链条是一个易损件,每年至少检查一次,并及时处理。2.各跳闸开关动作的灵活性和可靠性应定期检查,以免松动和损坏。3.经常检查电路连接器,保持连接牢固,插头可靠。4...

问:明弧堆焊和埋弧堆焊的工作原理是什么?答: 明弧堆焊★也称自保护焊,不需要辅助保护气体和焊剂只要药芯焊丝就可以直接焊接。明弧堆焊就是用自保护焊直接对焊材进行多层焊接的焊接方式。这种方式主要用于对抗磨要求质量高的器械等,如:磨煤辊,水泥磨,铲斗齿等。埋弧堆焊主要的焊接参数是电源性质和焊接电流、电弧电压、堆焊速度、焊...